Master Investment Policy and Objectives

1. Introduction

Investment Policy for the Sacramento County Employee’s Retirement System is documented in a Master Investment Policy Statement (IPS) and supported by individual asset class policy documents. The Master IPS is designed to establish broad policies that will guide SCERS’ investment program (Investment Program), including Investment Philosophies, Investment Objectives, Plan Governance, Investment Strategy, Risk

Management and Portfolio Monitoring.

The Sacramento County Employees’ Retirement System (SCERS or the System) was created on July 1, 1941, by Sacramento County Ordinance #283 as adopted by the Board of Supervisors on April 30, 1941, pursuant to the County Employees’ Retirement Law of 1937. SCERS provides retirement, disability, and death benefits for qualified employees of Sacramento County and eleven participating special districts.

A nine-member Board of Retirement (Board) governs SCERS. The Board has the sole and exclusive responsibility to administer SCERS in a manner that will assure prompt delivery of benefits and related services to the participants and their beneficiaries. See California Constitution at Articles XVI Section 17.

In administering the System, SCERS will value open communication, transparency, and the consideration of different points of view. It will also follow the highest ethical standards in meeting its fiduciary duties of prudence and loyalty to the System’s participants and beneficiaries, and will act solely in the interest of, and for the exclusive purpose of providing benefits and related services to participants and their beneficiaries.

2. Master IPS Purpose

The Master IPS is a principles based document that establishes broad policies that will guide SCERS’ Investment Program. It is intended to provide guidance to the Board, Staff, Stakeholders, and third-party professionals.

The System’s individual asset categories have their own dedicated investment policy

statements that include detailed information specific to the asset categories and underlying asset classes. Individual asset category IPSs contain objectives, investment guidelines, ranges, permissible investments, benchmarks, and monitoring specific to the asset categories and underlying asset classes. The individual asset category IPSs are included as supporting documents to the Master IPS.

3. Investment Philosophies

The Investment Philosophies represent the System’s principles on which the Investment Program is based. All investment decisions for the System are made within the context of these philosophies, which include:

- Strategic asset allocation has the greatest impact on long-term investment returns and volatility. Using quantitative asset/liability modeling coupled with qualitative evaluation, an appropriate strategic (long-term) asset mix target is determined and serves as the guide for the investment allocation throughout market cycles. The qualitative evaluation emphasizes the long-term sustainability of the system, mitigation of large drawdown risk, and the ability to achieve long term funding goals.

- The strategic asset allocation target is a well-diversified portfolio across asset categories and asset classes. However, it is recognized that the portfolio’s risk exposure is heavily influenced by equity risk, which historically has been favorably correlated with the ability to achieve long term funding objectives.

- While it is essential to hold to the Investment Program’s strategic asset allocation throughout market cycles, the ranges around the targeted asset class allocations allow for marginal adjustments as market opportunities arise. Under normal market conditions, asset category and asset class exposures will be rebalanced to target periodically to enforce a “buy low/sell high” approach across the portfolio.

- An allocation to low-cost investment strategies, including passive strategies, will be used in the most efficient asset classes. Active management strategies, and the fees associated with active management, are acceptable when the expected excess return over the strategy benchmark compensates the System for the active risk taken, and the fee incentives align with the System’s interests.

- Given the long-term nature of the System, investments that offer an illiquidity premium in return for a longer holding or lock-up period will be utilized to the extent that overall liquidity is not imperiled.

- The strategic asset allocation should generate sufficient levels of cash flow to support the System in meeting its benefit payment obligations.

4. Investment Objectives

A. The primary and over-arching goals of the System are to:

- Provide for current and future benefit payments, i.e. sustain the plan through its useful life.

- Diversify plan assets as its main defense against large market drawdowns, while maintaining reasonable risk exposure to meet return requirements.

- Preserve a degree of liquidity ample to meet benefit payments and capital calls, without incurring substantial transaction costs or “fire sales” of illiquid holdings.

- Incur costs that are reasonable and consistent with industry standards.

- Achieve funding goals, including the maintenance of funded status, and manageable, consistent contribution rates.

B. Investment performance objectives include:

- Returns in excess of policy benchmarks at the total fund and asset class levels over rolling three-year periods.

- The System’s total fund performance is evaluated by applying the investment performance of the asset class benchmarks to the Investment Program’s strategic asset allocation target (Policy Index). The Policy Index permits the Board to compare the Investment Program’s actual performance to its total fund benchmark, and to measure the contribution of active investment management and policy adherence.

- Achieve real (after inflation) returns at the total fund level that are at or above the actuarial real return (assumed return less per capita pay growth) over complete market cycles.

- For asset classes and actively managed portfolios, achieve net returns that exceed policy benchmarks, and rank in the top half of a competitive, after-fee universe.

5. Investment Program Governance

A. ROLES AND RESPONSIBILITIES

I. Board

With the authority noted above, the organizational structure of SCERS focuses the attention of the Board on governance and policy and not on the management of the System. The Board’s primary responsibility is to set and direct investment policies set forth in this document, set and direct the strategic direction of the System, and guide its progress in achieving its goals and objectives. The Board has fiduciary responsibility for the System and the Investment Program.

While the Board may delegate certain responsibilities under the Investment Program for purposes of implementation, administrative efficiency and expertise, the following areas are the primary responsibilities of the Board, which may not be delegated:

- The governance model of the Investment Program

- Establishing and maintaining investment policy, including:

- Investment philosophy

- This Investment Policy Statement (IPS)

- Investment objectives

- Strategic asset allocation

- Allocation-level performance benchmarks

- Risk philosophy

- Engaging Board consultants and service providers

- Monitoring the Investment Program

II. Investment Staff

The CEO is responsible for the overall management and administration of the System under the Board’s direction. The CIO and other Investment Staff, along with the CEO, are responsible for the implementation and maintenance of the Investment Program. The Investment Staff shall exercise the same fiduciary responsibility under applicable law as the Board. Staff shall act reasonably as custodians of the public trust, and shall recognize that the Investment Program is subject to public review and evaluation. The overall management of the System’s Investment Program shall be designed and

managed with a degree of professionalism that is worthy of the public trust.

Key responsibilities of the Investment Staff include:

- Implementation and oversight of the System’s Investment Program, including policies, structures, investment mandates, systems, service providers, and cash flows.

- Assisting the Board in the formulation and evaluation of investment policies and strategy, the development of the strategic asset allocation and asset class structures, and the risk management framework.

- Development and recommendations regarding investment mandates, service providers, and investment management tools and systems.

III. General Consultant

General Consultant responsibilities include, but are not limited to, providing the Board guidance on strategic asset allocation and interim market tactics, selection and monitoring of plan and manager performance, assisting with documentation, and guiding Board education.

The General Consultant is and shall agree to be a fiduciary to the System under California law. The General Consultant works with Investment Staff in the development of recommendations while recognizing its fiduciary duty is to provide prudent investment advice to the Board. The General Consultant provides advice without discretionary authority to execute on its advice. The specific duties of the General Consultant are contained in an Agreement for Investment Consulting Services, and

generally include providing advice with respect to:

- Investment strategy development and implementation

- Investment policy development

- Asset allocation among asset classes and subclasses

- Investment manager selection, evaluation and termination

- Investment performance monitoring

- Investment risk monitoring

- Capital markets projections

- Coordination with the System’s actuary in conducting periodic asset/liability studies and other required reporting

- Board education

- Collaboration with Investment Staff on maintaining an investment manager WatchList

IV. Alternative Assets Consultants

The Alternative Assets Consultants are and shall agree to be a fiduciary to the System under California law. The Alternative Assets Consultants works with Investment Staff in the development of recommendations while recognizing their fiduciary duties are to provide prudent investment advice to the Board. The Alternative Assets Consultants provide advice without discretionary authority to execute on their advice. The specific duties of the Alternative Assets Consultants are contained in an Agreement for Investment Consulting Services.

Responsibilities of the Alternative Assets Consultants include, but are not limited to, developing and maintaining strategic plans for the System’s Absolute Return, Private Equity, Private Credit, Real Assets and Real Estate Investments. This includes manager selection, monitoring and due diligence, maintaining liquidity and pacing projections, and Board education.

V. Investment Managers

A. Investment Managers of Custodied Assets

Subject to this IPS and their specific contractual obligations to the System, Investment Managers are responsible for making investment decisions on a discretionary basis (unless stated otherwise within their investment contract) regarding assets placed under their jurisdiction, and will be accountable for achieving their investment objectives.

Decisions include the purchase, sale, and holding of investments in amounts and proportions that are reflective of the stated investment mandate. Investment managers shall maintain (1) errors and omissions insurance, (2) directors and officers liability insurance, (3) cybercrime insurance, and (4) fidelity bond (financial crime), in a commercially reasonable amount not under $5 million each. Staff may, in its reasonable discretion and for good cause, require or accept insurance coverage and/or levels that deviate from those in the foregoing sentence.

In addition, SCERS’ investment managers agree to notify the Board Chairman, SCERS’ CEO, and/or Investment Staff, in writing, if they are unable to continue acting in the capacity of a fiduciary or investment advisor. As stated above, investment managers are expected to act as prudent experts in the management of account(s) for SCERS, and agree to be fiduciaries to the System. In fulfilling their roles, investment managers will continually educate the Board about capital market developments that pertain to their area of investment expertise.

B. Fund Managers and General Partners

Managers and General Partners of commingled funds in which SCERS is a limited partner have the responsibilities and duties set forth in their respective limited partnership agreements and side letters. With respect to such fund managers and general partners, SCERS will strive to obtain their contractual agreement to a fiduciary duty of care, in accordance with and subject to the provisions of the Alternative Assets Investment Standard of Care Policy.

VI. Custodian Bank

The System’s Custodian Bank is responsible for the safekeeping of assets, trade reconciliation and settlement, income collection, short term investing, securities lending, commission recapture, and compliance monitoring.

The Board may authorize the Custodian Bank to invest in temporary short-term fixed income investments both for the investment strategies and as a part of the cash portion of the System’s assets. Such investments will be managed in general accordance with short-term fixed income investment guidelines as detailed in the custodial agreement. The Custodian Bank, per the custodial bank agreement/ contract, may be authorized to conduct a securities lending program within liquidity and risk constraints as authorized by the custodial agreement.

B. IMPLEMENTATION PROTOCOLS

I. Vendor Procurement

The following implementation protocols describes the allocation of investment authority and responsibilities between SCERS’ Board, Staff, and consultants. Overall, the implementation protocols delegates the most time intensive elements of the process to Staff and consultant, while preserving the Board’s oversight of the overall asset categories and their underlying asset classes.

The Board will approve the long-term Asset Allocation Structure for the individual asset classes within the asset categories, as developed and presented by Staff and Consultant. The long-term Asset Allocation Structure for underlying asset classes will articulate the long-term direction and objectives of each asset class including elements such as: (1) asset allocation targets and ranges by strategy, geography and style, and types of investment vehicles; and (2) for alternative assets/private markets asset classes, a target range for the number of investment managers, and the role of Fund of Funds and strategic partners.

On an annual basis, the Board will approve the Annual Investment Plan for the individual asset classes within the asset categories. The Annual Investment Plan will articulate the direction over the next year in taking the necessary steps to achieve the above objectives of the long-term Asset Allocation Structure of the underlying asset classes.

The execution of the long-term Asset Allocation Structure and Annual Investment Plan will vary between that of traditional assets/public markets investments and alternative assets/private markets investments.

Traditional assets/public markets investments include:

- Global Equity

- Fixed Income

- Public Credit

- Liquid Real Return

Alternative assets/private markets investments include:

- Absolute Return

- Private Equity

- Private Credit

- Real Estate

- Real Assets

The primary difference between the traditional assets/public markets and alternative assets/private markets implementation process is as follows. For alternative assets/private markets investments, the selection of investment managers is delegated to Staff, subject to the Board’s ability to review, discuss, and object to the recommendations of Staff and consultant during the investment protocol process. For traditional assets/public markets investments, the Board makes the final decision at a Board meeting after a presentation by the candidate recommended by Staff and the consultant.

a. Traditional Assets/Public Markets:

Overall, the traditional assets/public markets implementation protocol delegates the most time intensive elements of the process to Staff and consultant, including the screening and evaluation leading to the recommendation to engage or terminate a particular investment manager. The Board provides oversight of the overall traditional assets/public markets programs and makes the final decision regarding engagement or termination of investment managers.

The key features of the traditional assets/public markets implementation protocol are as follows:

- If Staff and the consultant believe that a change is necessary to the manager structure in order to obtain optimal performance from the asset class, Staff and the consultant will present the Board with a report outlining the basis for their conclusion including how the change under consideration would fit within: (a) the allocation model for the asset class approved by the Board; and (b) the annual investment plan approved by the Board.

- Staff and the consultant will then identify the most qualified candidates to bring into the manager structure based on the full range of relevant factors regarding the manager, its investment team, and strategy. Staff will prepare a report for the Board outlining why the managers in question have been identified for closer evaluation for a possible commitment. The consultant will also provide investment strategy and operational due diligence reports.

- Staff and the consultant will pursue more extensive due diligence on the manager candidates, including conducting extended interviews with the portfolio managers and other key members of the investment team. Legal counsel will begin reviewing the documentation for the possible engagement and preliminary negotiation of deal terms will take place.

- If/When: (a) the due diligence process is completed; (b) deal terms have been determined; (c) staff and the consultant have determined which manager(s) to recommend to the Board; then (d) staff will prepare a report to the Board outlining the basis for the decision, the proposed commitment amount, and the target date for closing on the commitment.

- At any point in the process, questions or concerns by a Board member regarding a proposed investment or proposed manager can be communicated to the Chief Executive Officer (CEO). The CEO will be responsible for assuring that a prompt response is provided. The CEO will also provide the full Board with the response. If the Board member is not satisfied with the response, the Board member can request that the matter be brought to the full Board for consideration. In such a case, the CEO will refer the matter to the Board President who will determine whether the manager search process should be suspended until the matter is resolved. As a general rule, it is anticipated that the process of identifying and vetting a proposed investment will take place over a period of time sufficient to allow, if necessary, for full Board consideration of questions or concerns before a recommendation is finalized.

- The manager(s) being recommended for the engagement will make a presentation to the Board. At that time the Board can address any questions or concerns regarding the recommended candidate as well as any previously raised questions or concerns regarding another candidate or candidates. The Board can (a) approve engagement of the recommended manager; (b) direct that one or more alternative candidates be brought forward for consideration; (c) request further information regarding a candidate or candidates; or (d) take any other action the Board deems appropriate.

- If the new investment manager(s) engagement also involves the recommended termination of an existing manager(s), Staff and the consultant will develop and report to the Board on the reasons (as listed in the Vendor Termination section below), timeline, and plan for terminating the existing engagement, and transitioning the assets from the outgoing manager to the incoming manager. The Board will take action on the recommended termination.

- If Staff and the consultant determine that it would be advisable to physically re-balance the portfolio at the same time as making the investment manager structure changes, Staff and consultant will prepare a report for the Board outlining the recommended physical re-balancing and why it is necessary and appropriate. The Board will take action on the recommended physical re-balancing.

- Upon approval by the Board: (a) the new investment engagement will be finalized and the necessary documentation executed; (b) the engagement with the outgoing manager will be terminated; and (c) the transition plan, and any necessary physical re-balancing, will be implemented.

- SCERS’ Board President or Chief Executive Officer are authorized to execute any and all documents which may reasonably be required to complete a new investment engagement, to terminate an engagement with an outgoing manager, and to effectuate a transition of assets on behalf of SCERS.

- Staff and the consultant will report to the Board when the manager structure changes and any necessary re-balancing have been completed, along with an analysis of the costs associated with the transition.

b. Alternative Assets/Private Markets:

For the alternative assets/private markets asset classes, the execution of the long-term Asset Allocation Structure and Annual Investment Plan including the selection of investment managers will be delegated to Staff, subject to the Board’s ability to review, discuss, and object to the recommendations of Staff and consultant during the investment protocol process.

The key features of the alternative assets/private markets investment protocol are as follows:

- Staff and consultant will identify the most qualified candidates for a prospective absolute return, private equity, private credit, real estate, or real assets investment commitment based on: (a) the Asset Allocation Structure for the underlying asset classes approved by the Board; and (b) the Annual Investment Plan for the underlying asset classes approved by the Board (which takes into

account SCERS’ investments and prioritizes and targets optimal new investment opportunities that complement those investments, and in the case of private markets investments, are expected to come to market in the next twelve months). - When a particular manager candidate is identified, Staff and consultant will pursue extensive due diligence on the manager candidate, including conducting extended interviews with the portfolio managers and other key members of the investment team.

- The consultant will complete its investment strategy and operations due diligence reports, if they have not done so already. Legal counsel will begin reviewing the documentation for the possible commitment/investment amount, and preliminary negotiation of deal terms will take place.

- Staff will prepare a detailed Initial Report for the Board outlining the basis for the potential commitment/investment, the contemplated commitment/investment amount, the target date for closing on the commitment/investment, and an assessment of the fit within SCERS’ portfolio. The Initial Report will include an evaluation of the organization, investment strategy, considerations and risks, and track-record, as well as an operational assessment and a review of the investment’s terms.

- If/When: (a) the due diligence process is completed; (b) deal terms have been determined; (c) staff and consultant have concluded that a commitment/investment should be made; then (d) staff will prepare a Final Report for the Board outlining the basis for the decision, the proposed commitment/investment amount, and the target date for closing on the commitment/investment. The Final Report will summarize the due diligence items that have been completed in order to move forward with a commitment/investment, as well as any considerations that have arisen since the issuance of the Initial Reports by Staff and the consultant.

- At any point in the process, questions or concerns by any trustee regarding a proposed investment or proposed manager will be communicated to the Chief Executive Officer (CEO). The CEO will be responsible for assuring that a prompt response is provided. The CEO will also provide the full Board with the response. If a Board member is not satisfied with the response, the Board member can request that the matter be brought to the full Board for consideration. In such a case, the CEO will refer the matter to the Board President who will determine whether the manager search process should be suspended until the matter is resolved. As a general rule, it is anticipated that the process of identifying and vetting a proposed investment will take place over

a period of time sufficient to allow, if necessary, for full Board consideration of questions or concerns before a commitment is finalized. - Absent questions or concerns by the Board, the proposed investment will be finalized and the necessary documentation executed, and in the case of Absolute Return, funds placed with the manager.

- SCERS’ Board President or Chief Executive Officer are authorized to execute any and all documents which may reasonably be required to complete any Absolute Return, Private Equity, Private Credit, Real Estate, or Real Assets investment on behalf of SCERS.

- Staff and consultant will confirm that the commitment/investment has been made, and the amount allocated to SCERS, at a subsequent Board meeting.

- Because management of the aggregate Absolute Return portfolio is dynamic and ongoing, Staff and the consultant will also have authority to make adjustments to the Absolute Return portfolio in order to assure that the portfolio is optimally aligned to achieve the objectives of the asset class. This includes, but is not limited to the authority to: (1) trim or add to existing investment

mandates; (2) terminate and/or replace an existing manager; (3) submit redemption requests; (4) determine the appropriate sources for funding a new mandate or adding to an existing mandate; and (5) determine the appropriate application of any returned capital. - If and when Staff and consultant determine that such actions are necessary, a timely report will be prepared outlining why the action is/was deemed necessary and how it impacts SCERS’ Absolute Return portfolio. Notice will be promptly provided to the Board regarding the action and the report will be put on the secure Board website.

c. Cash:

- Staff and General Consultant will determine the most effective approach toward implementation of cash, and recommend any changes to the Board for approval.

- Examples of approaches toward cash implementation include short-term investment funds (STIF), short duration government bonds, and a demand deposit account (DDA) that pays an interest rate tied to overnight LIBOR/SOFR rates.

II. Vendor Termination

a. General Termination

From time to time it will be necessary for the System to terminate a contractual relationship with an investment manager. The Board has established the following criteria to assist in making termination decisions. The overriding consideration with respect to all decisions is that they shall be made solely in the best interest of the System.

Any action to terminate an investment manager may be based on one or more

but not limited to, the following primary criteria:

- Significant changes in firm ownership and/or structure

- Loss of one or more key personnel

- Significant loss of clients and or/assets under management

- Shifts in the firm’s investment philosophy or process

- Significant and persistent lack of responsiveness to client requests

- Changes in SCERS’ investment strategy eliminating the need for a particular style or strategy

- Persistent violations of the strategy’s investment guidelines

- Investment performance that has fallen below policy benchmarks and SCERS’ expectations

- Accusations of theft or fraud by a regulatory agency or other government body

- Any other issue or situation of which Investment Staff and/or Consultant become aware that is deemed material

The ability to terminate an investment manager is defined within the contractual agreement with each investment manager. Within the traditional assets/public markets, most of SCERS’ separate account mandates are structured with immediate termination rights, while most commingled funds have specific redemption schedules, varying from daily to quarterly.

Within the alternative assets/private markets asset classes, the ability to terminate an investment manager is defined within the contractual agreement with the manager. Open- end funds, including Absolute Return and Real Estate investments, typically have monthly and quarterly termination rights, subject to lock-up periods and investor level gates. Closed-end funds within the private markets, including Private Equity, Private Credit, Real Assets and Real Estate, are generally illiquid structures with five to fifteen year holding periods. Any early liquidity within closed-end funds is typically achieved through the dissolving of the fund, by either the limited partners or the general partner prior to the end of a fund’s term, or selling a limited partner stake in a fund in the secondary market.

b. Emergency Termination – traditional assets/public markets

In the case of an emergency within the traditional/liquid asset classes, SCERS may immediately terminate an investment manager for any reason without prior notice, subject to the termination language within the investment contract with the manager, and subject to liquidity provisions of the investment strategy. In most cases, any action to terminate a manager should be taken by the Board

upon the recommendation for termination by Staff, with the concurrence of the Investment Consultant at either a regularly scheduled or specially called Board meeting. If the CEO and the CIO determine, in consultation with the Investment Consultant and the General Counsel, and with the concurrence of the Board President or one or more Vice-Presidents if the President is not available, that: (1) it is necessary to immediately terminate an investment manager in order to protect the assets under the control of the investment manager; (2) it is not feasible to convene a meeting of the Retirement Board for that purpose in a timely manner; and (3) delay could result in detrimental impact to SCERS’ assets or interests, the CEO or the CIO may terminate the agreement with the investment

manager. The CEO or the CIO shall immediately report such termination to the Board, along with a report of the circumstances that prompted such action.

Whenever the CEO or the CIO exercise the authority to terminate an agreement with an investment manager as provided above, he or she may also take whatever actions he or she may determine, in consultation with the Investment Consultant and the General Counsel, and with the concurrence of the Board President or one or more Vice-Presidents if the President is not available, are reasonable and necessary to transition the assets under the control of the investment manager to alternate management, including, without limitation: (1) temporarily assigning the assets to another existing contracted investment manager; (2) identifying and engaging an alternate investment manager to

manage the assets until a permanent replacement for the terminated manager can be engaged; or (3) contracting for the services of a transition manager to facilitate an efficient and cost effective transition of the assets between the former and interim manager. The CEO, or in his or her absence, the CIO, may execute any and all agreements reasonably necessary to facilitate an orderly and efficient transition of the affected assets, so that they will be managed and protected until they are assigned to one or more alternate investment managers.

The CEO, or in his or her absence the CIO, shall immediately report any and all steps taken to transition the assets and to protect the interests of SCERS to the Board.

III. Portfolio Rebalancing – Overlay Program and Physical

On a quarterly basis, the Investment Staff will report all rebalancing activity, either physical or via the Overlay Program.

a. Overlay Program

- The Overlay Program, which is managed by an external investment manager, is utilized to monitor and rebalance the asset allocation to policy targets, and to invest available cash.

- Under the supervision of the CIO and working with Consultants, quarterly rebalancing, primarily using derivatives, will occur in order to maintain exposures within defined bands and approaching long-term targets.

- The rebalancing frequency, rebalancing methodology, and overlay proxies are defined within the Investment Management Agreement for the Overlay Program.

b. Physical Rebalancing

- When a physical rebalancing is appropriate, as determined by the CIO, it will be directed by the CIO, who will determine the most cost effective approach.

- Any physical rebalancing will be reported, along with associated costs, at the subsequent Board meeting.

6. Investment Strategy

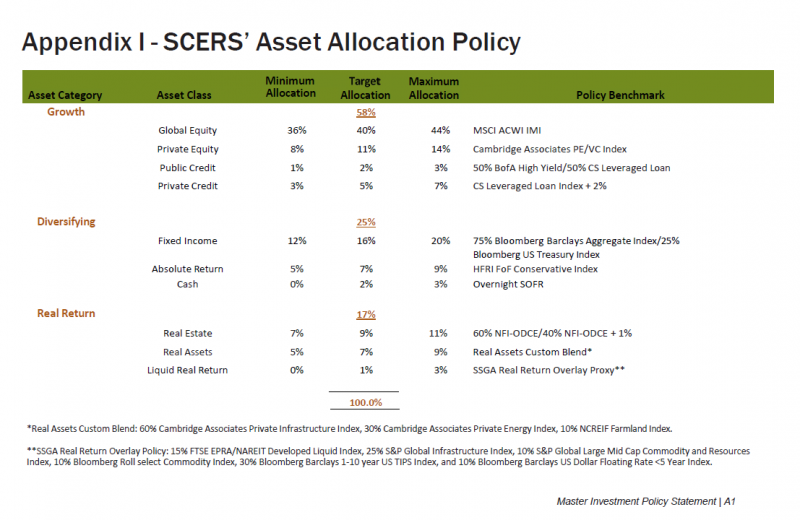

An important component of the System’s investment strategy is to view risk exposures through multiple lenses, including functional and common factor exposures, in order to manage and maintain allocations that are aligned with its investment philosophy and objectives. The multiple lens approach allows the System to better understand the sources of its returns and risks and to make informed adjustments to exposures when

appropriate. Appendix One shows the Board approved desired functional asset category and asset class (Policy Index) exposures. Common factor exposure will be included in the performance reviews.

The Board will conduct periodic reviews (at least every five years) of its strategic asset allocation linked with projected liability behavior.

7. Asset Allocation

A. Growth Asset Category

The Growth asset category includes assets that are exposed to equity and credit risk factors. They tend to perform best when economic growth is average or above and/or rising, and inflation is moderate and/or falling. Asset classes within the Growth asset category include:

- Global Equity

- Public Credit, i.e., high yield credit and bank loans

- Private Credit

- Private Equity

B. Diversifying Asset Category

The Diversifying asset category includes assets that are expected to help preserve capital in periods of market distress, particularly in periods of low and falling growth. In such periods, diversifying assets may experience negative returns but are expected to perform better than growth assets, and are expected to enhance diversification by exhibiting low or negative correlation with both equity and credit markets. Diversifying assets are expected to have a positive return profile over market cycles. Asset classes within the Diversifying asset category include:

- Fixed Income, including US Treasuries and Core and Core-Plus strategies

- Absolute Return, including absolute return strategies that have low to negative correlation and low beta to equity and credit markets

- Cash – the dedicated 2% cash allocation is included in Diversifying asset category and serves as a liquidity tool. It is intended to close the gap between annual benefit payments and total contributions in an environment where investment earnings fall short of the targeted assumed rate of return, and is used as a source of liquidity prior to other Plan assets during a stressed liquidity environment.

C. Real Return Asset Category

The Real Return asset category includes assets that should perform well in periods of unexpectedly rising inflation while producing positive net real returns over complete market cycles. The category should also provide moderate levels of income and cash flow generation. Additionally, Real Return assets should enhance diversification by exhibiting low or negative correlation with both equities and nominal bonds. Asset classes within the Real Return asset category include:

- Real Estate, including both Core and Non-Core exposures

- Real Assets, including infrastructure, energy and power, and agriculture/timber

- Liquid Real Return

8. Risk Management

Risk is inherent in a defined benefit pension plan’s investment portfolio, putting a high premium on maintaining the appropriate risk level throughout market cycles. However, the System recognizes that there may be infrequent periods when risk levels become extreme and expected risk premia do not justify the exposure. While the System’s primary risk management approach is broad diversification and disciplined rebalancing, the System will assign ranges around exposures to accommodate asset preservation during

periods of market unrest, allowing for the ability to increase liquid defensive positions (i.e. Treasuries) and reduce liquid growth exposures (i.e. Equities and Credit). The System views risk through multiple lenses in order to address the following circumstances:

- Large drawdowns

- Maintenance of real actuarial earnings expectation and purchasing power

- Ability to meet benefit payments and capital calls (i.e. liquidity)

- Avoid large volatility in contribution rates

In periodic performance reports, the System will monitor the following characteristics to

keep track of various portfolio risks:

- Actual allocations vs. target allocations

- Risk Factors, including exposure to equity, credit, inflation, interest rates, and currencies

- Exposures and liquidity/pacing provisions in private market asset classes

- Longer-term volatility (standard deviation) relative to policy

9. Portfolio Monitoring

A. Reporting

I. Quarterly Reporting

The Board will receive quarterly performance and exposure reports from its General and Alternative Assets Consultants. The reports will generally include performance results and comparisons to benchmarks and peers, as well as asset class and risk exposure relative to policy allocations.

II. Annual Reporting

On an annual basis, Staff, with assistance from the Investment Consultants, will provide an ‘Investment Year in Review’ for the Board. This report and presentation will highlight investment activity for the total fund and individual asset categories and asset classes during the prior calendar year, and preview anticipated investment objectives and activity for the upcoming calendar year.

B. Compliance Monitoring

Monitoring of compliance with manager investment guidelines will be performed monthly by the CIO and Investment Staff relying on data provided by the custodian, consultants, and investment managers. In addition, the CIO and Investment Staff will monitor performance and attribution characteristics, and dispersion of results relative to expectations. On an annual basis, the CIO and Investment Staff will request and review each manager’s form ADV Part II and will inform the Board of significant changes and apparent conflicts of interest.

C. Watch List

The Watch List status will be determined and monitored by the Investment Staff and Consultants, focusing on relative performance and organizational instability. Decisions to add or remove an investment manager to/from the Watch List will be less rules-based and more a function of analyzing both quantitative and qualitative factors related to the investment manager. Investment managers on the Watch List will be subject to enhanced scrutiny and are subject to termination upon Board approval of Staff recommendation.

Investment manager additions and removals from the Watch List will be communicated to SCERS’ Board monthly.

D. Manager Due Diligence

The Investment Staff and Investment Consultants will monitor individual investment managers’ performance quarterly and annually. The Investment Staff and Consultants will meet with all investment managers periodically. Typically, these meetings will occur in the SCERS/Consultants’ offices or through a web conferencing platform (i.e., Zoom). However, manager on-site meetings may be scheduled for existing managers, Watch Listed managers, and as a part of new investment manager due diligence.

10. Other Investment Considerations

SCERS recognizes that corporate business practices associated with an underlying investment or investment firm, including approaches to environmental or ethically responsible strategies—commonly referred to as “ESG” (environmental, social, governance)—may present financial risks or opportunities for the System. SCERS will identify, evaluate, and manage material and financially relevant factors in its investment process to safeguard and enhance System performance. Consideration of these factors shall be conducted in conjunction with other relevant factors in a manner that helps SCERS achieve its strategic objectives.

If the Legislature, by statute, prohibits any investments by boards operating under the County Employees Retirement Law of 1937 (CERL) under the authority of section (g) of article XVI, section 17 of the California Constitution, then the SCERS Board will undertake an independent investment analysis to determine whether such a prohibition satisfies the standards of fiduciary care and loyalty required of the SCERS Board pursuant to the California Constitution and Government Code sections 31594 and 31595 of CERL.

History

Amended February 21, 2024

Amended June 21, 2023

Amended June 15, 2022

Amended March 17, 2021

Amended September 18, 2019

Amended on March 20, 2019

Restated on July 19, 2017 as “SCERS Master Investment Policy Statement”

Amended on February 18, 2010

Amended on December 18, 2008

Adopted on January 17, 2008 as “SCERS Investment Policy & Objectives”

Appendix